The Food and Drug Administration (FDA) appoints drug experts to drug advisory committees (ACs) that make approval or rejection recommendations for about half of all new drugs (usually the unique ones, such as Covid vaccines). The experts receive nonpublic technical reports from drug firms and FDA staff a month or so before ACs meet. Our recent study is the first to examine potentially informed options trading around the report creation dates (not publicly known), as well as the AC meeting dates (publicly known).

The study is important because there could be relatively large amounts of informed trading months before the FDA decides whether to approve a drug, occurring earlier than previously understood by insider trading work such as that summarized in Augustin and Subrahmanyam (2020). The Securities and Exchange Commission (SEC) could miss this trading unless it starts monitoring relatively early, around when reports are created and ACs meet. We can examine trading around report-creation dates because we obtain those dates from the report files. The files are loaded on the FDA website the day before ACs meet. The public knows when ACs meet, but has no access to the reports until just before the meetings. The experts and drug firm employees, however, have access to the reports around the times that they are created, usually a month or so before the AC meetings. This adds a new perspective on informed trading ahead of corporate events.

The SEC has recently brought several cases of insider trading against FDA staff or scientists.[1] Reeb, Zhang, and Zhao (2014) suggest that there is more insider trading when firms pass information to regulators.[2] In our case, potential insiders include firm employees and FDA staff constructing reports, experts on ACs who receive the reports, and their contacts. AC-member trading is a potential public health issue because some studies find that AC members’ financial conflicts sway their votes, perhaps leading to inappropriate drug approvals.[3]

Earlier studies of informed trading often rely on stock-based evidence, but our option-based evidence could be more reliable. It produces stronger results, perhaps because informed traders prefer the higher leverage and expected returns of options. Options traders can also capture returns from expected changes in return volatility.

Bohmann and Patel (2018) examine informed options trading around the FDA’s final decisions to approve or reject new drugs. But when AC’s are used, most of the relevant information is contained in the reports and available early to certain firm employees, FDA staff, and AC members. The FDA typically releases its final decision months after it receives AC recommendations, even though it follows those recommendations in most cases. Hence, informed trading around the FDA’s final decision may be less common because most of the news is likely out by then.

Our connected series of events provides complementary evidence to better support the claim of informed trading. Earlier studies typically consider option trading before public events, such as earnings announcements. Our event sequence includes firm-report creation (nonpublic), followed by FDA-report creation (nonpublic), and finally the AC meeting (public). The pool of potential insiders grows over time, and therefore there could be different levels of informed trading around the different events.

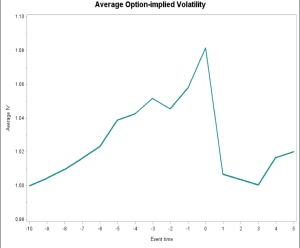

Based on the pool size, we expect more trading just before the meeting dates than before report creation dates, and this is what we find. Of course, this is not a given. The decision of when to trade depends on informed traders’ perceptionS of the value of their information, when that value will get impounded in stock price, and the potential for other offsetting company news releases. Waiting avoids exposure to unexpected firm news, but waiting too long risks losing out to other informed traders and also bearing the cost of a sharp rise in implied volatility leading up to the meeting date (see Figure 1).

Figure 1: Average option-implied volatility around AC meetings. This figure depicts the daily average option-implied volatility (IV) around AC meeting dates. We calculate IV as open-interest weighted IV using all outstanding options. Values are presented as a percentage of the IV on day -10 over the period [-10, 5]. The sample includes 319 drug AC meetings from January 1998 to December 2017.

There could be more informed trading around the FDA-report date than the firm-report date, partly because the FDA report follows the firm report, and the informed pool is larger. But there may also be more significant new information in the FDA report. Firms typically release some clinical results publicly as they progress through several clinical trials, so any new information in the firm report is mostly late-arriving clinical results or technical data. The FDA report provides a critical assessment of all of the drug’s clinical results and likely signals the FDA’s final approve or reject decision unless the AC sharply disagrees. Therefore, we expect more informed trading around the FDA-report date than the firm-report date, and this is what we find.

We hand collect data for all drug AC meetings from 1997 to 2017, including 319 meetings for over 20 drug advisory committees. We find around 32 percent of advisory meetings have statistically significant, positive, abnormal option volume prior to the meeting date, and the options tend to be short-maturity and out-of-the money. We also find smaller but still positive abnormal volume before both the firm-report dates and the FDA-report dates. Those options tend to be longer-maturity, perhaps because the reports are publicly released a month or more after they are created, just before the meeting. Conversely, we find no abnormal stock trading volume before the report dates.

We repeat the analysis using an event-study regression framework to control for trading due to typical investor uncertainty. We still find abnormal volumes. We do the same for alternative informed options trading measures and also find informed trading. We create pseudo-events for a sample of control firms matched to our sample firms, and then adjust sample firms’ abnormal trading for the matched firms’ abnormal trading. Our conclusions do not change.

We next explore informed investors’ preferences between selling or buying options. Using the International Security Exchange (ISE) dataset, we find that informed investors often sell options close to AC meetings. This is consistent with Cremers, Fodor, and Weinbaum (2017), who find that informed investors often sell options near scheduled events (e.g. AC meetings) because they can earn money when the stock price moves in their expected direction and also when implied volatility falls following the scheduled event.

In addition, we find that Informed investors use more small trades, perhaps to help conceal their trades from regulators. Furthermore, we find that abnormal options volume accurately predicts the meeting results. That is, informed investors tend to sell puts or buy calls before meetings where ACs recommend drug approval. Conversely, they tend to sell calls or buy puts before meetings where ACs recommend drug rejection.

Lastly, we investigate the cross-sectional distribution of informed trading and find that the magnitude of abnormal volume is much larger for small firms than for large firms. A potential reason is that large firms with many drugs can have large normal volume, making the informed trading related to a particular drug hard to detect. For a one-drug firm, however, its normal options volume may be small, making the added informed trading easier to detect.

Our paper contributes to the literature in three ways. First, it examines informed trading around events that are regulated by the government and can affect public health. Second, it studies a series of connected events that together provide complementary evidence of informed trading. Third, it highlights informed trading months before expert committees meet or the FDA makes its final decision. This suggests that regulators should consider a wider window to investigate informed trades related to the 50 percent of new drugs evaluated by ACs.

Our results suggest that such trading in small firms’ options may be easier to detect. Trading by advisory committee members could influence their advice as well, affecting which drugs get approved. This conflict of interest could be more widespread because we only study a small portion of the hundreds of federal advisory committees serving over 50 federal agencies (Ginsberg 2009).

ENDNOTES

[1] In 2012, the FDA chemist Cheng Yi Liang was sentenced to 60 months in prison for insider trading that generated more than a $3.6 million profit. In 2014, the SEC charged two clinical trial doctors, Dr. Franklin M. Chu and Dr. Daniel J. Lama, with illegally trading on inside knowledge. In 2016, the former FDA deputy director, Gordon Johnston, was accused of deceptively obtaining confidential information for hedge fund managers. For more information, see: https://www.sec.gov/spotlight/insidertrading/cases.shtml, https://www.sec.gov/news/pressrelease/2016-119.html

[2] Reeb, D.M., Zhang, Y. and Zhao, W., 2014. Insider trading in supervised industries. The Journal of Law and Economics, 57(3), pp.529-559.

[3] Congress is sensitive to this issue. For example, after Vioxx had to be removed from the market due to serious side effects, a congressional committee found that a majority of the AC members who voted to approve the drug had financial conflicts. As Congressman Maurice Hinchey commented, “[T]he public health is jeopardized at the expense of inappropriate and personal interests. These appointments flat-out undermine the objectivity of committee advice and bias recommendations” (H.R. Rep. No. 109-255 [2005], 151 Cong. Rec. 9393).

REFERENCES

Augustin, P. and Subrahmanyam, M.G., 2020. Informed options trading before corporate events. Annual Review of Financial Economics, 12, pp. 327-355.

Bohmann, M. and Patel, V., 2018. Informed options trading around US FDA announcements. Working paper, University of Technology Sydney.

Cremers, M., Fodor, A. and Weinbaum, D., 2017, August. How Do Informed Option Traders Trade? Option Trading Activity, News Releases, and Stock Return Predictability. Working paper, University of Notre Dame, Ohio University, Syracuse University.

Ginsberg, W.R., 2009, April. Federal advisory committees: An overview. Congressional Research Service.

This post comes to us from Zekun Wu, a PhD student at the University of Connecticut, and from professors Paul Borochin at the University of Miami and Joseph H. Golec at the University of Connecticut. It is based on their recent paper, “Informed Options Trading Before FDA Drug Advisory Committee Meetings,” available here.

Sky Blog

Sky Blog