Robo-voting occurs when an investment fund mechanically follows the voting recommendations of its proxy adviser in corporate elections. The practice has become easier for funds with the development of online voting platforms that a proxy adviser can complete in advance with its recommended votes. In a new study, we examine over 65 million votes cast by 14,582 mutual funds from 2008 to 2021 to assess the prevalence of robo-voting and its impact on corporate elections. We find that robo-voting is common but, somewhat paradoxically, not an important factor in most corporate elections.

Policymakers are concerned about robo-voting .[1] One SEC commissioner worried about “rote reliance” on proxy advice: “[t]he last thing we should want is for investment advisers to adopt a mindset that leads them to blindly cast their clients’ votes in line with a proxy advisor’s recommendation, especially given that such recommendations are often not tailored to a fund’s unique strategy or investment goals.”[2] A corporate-funded think tank reported that “[r]obo-voting enhances the influence of proxy advisory firms, undermines the fiduciary duty owed to investors, and poses significant threats to both the day-to-day management and long-term strategic planning of public companies.” [3]Robo-voting may also give kingmaking power to the two proxy advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis, that serve more than 90 percent of the market for proxy advice, and there is some concern that their advice is politically slanted. [4]

Yet, defenders of robo-voting argue that it allows funds with limited access to information to vote their preferences at low cost. Mutual funds, especially passive investors like index funds, have weak incentives to monitor and acquire information about the companies in their portfolios. The cost of becoming informed is substantial because of how many votes a diversified fund casts; Vanguard, for example, voted on nearly 169,000 separate election items in 2018. [5] Those in the proxy advisory business typically downplay the significance of robo-voting. At an SEC roundtable in 2018, the leaders of ISS and Glass Lewis stated that the vast majority of their clients voted according to customized policies, and one investment adviser claimed that “the term ‘robo-voting’ is a red herring. It doesn’t exist.”[6]

A challenge in studying robo-voting is that funds do not generally disclose the identity of their proxy adviser, if any. To solve this problem, we employ a new method developed by Shu (2022) that infers the identity of a fund’s proxy adviser from how its N-PX form, which reports its votes, is formatted. [7] Using this approach, we can identify funds that are customers of ISS and Glass Lewis. We define a fund-family as a robo-voter in a given year if almost all of its votes (using 99 percent and 99.9 percent cutoffs) were in line with the recommendation of its proxy adviser.

We find that in 2021 a substantial fraction of fund-families – approximately one-third in our sample – were robo-voters: 22 percent robo-voted with ISS, 4 percent robo-voted with Glass Lewis, and 6 percent robo-voted with management, using the 99 percent classification. This adds up to a total robo-voting prevalence of 33 percent among fund families. Using a 99.9 percent definition, 20 percent of fund families were robo-voters. We also examine robo-voting by customers of different proxy advisers. In 2021, 35 percent of ISS customers and 33 percent of Glass Lewis customers were robo-voters.

|

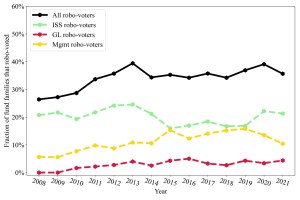

Figure 1. Robo-Voting Over Time

|

Over time, we find modest growth in the use of robo-voting. Figure 1, using a 99 percent cutoff, shows that robo-voting increased in the earlier years of our data, 2009-2013, but has remained approximately stable since then.

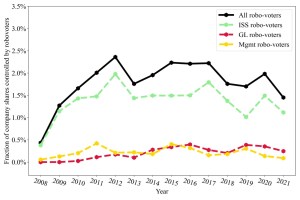

This evidence lends some support to those concerned about robo-voting: It is in fact quite common. However, we also find that robo-voting funds tend to be smaller than non-robo-voting funds. Because robo-voters control fewer shares, their impact on corporate elections is less than what their absolute numbers suggest. To quantify the voting power of robo-voters, Figure 2 displays the average percentage of votes cast by robo-voting fund families (using the 99 percent cutoff ) across the entire period we examine.

|

Figure 2. Mean Percentage of Votes Cast by Robo-Voters |

The figure reveals that around 2 percent of shares were robo-voted in recent years. In 2021, the share of votes cast by ISS robo-voters was 1.1 percent, Glass Lewis robo-voters 0.2 percent, and management robo-voters 0.1 percent. Given that most corporate elections are one-sided, these percentages imply that robo-voters were not pivotal for most elections; they mattered only when the winning margin was small. We find that the winning margin was less than the fraction of shares cast by robo-voters in less than 2 percent of elections. While there are certainly cases in which robo-voters were pivotal, the data do not paint a picture of robo-voters as dominating corporate elections.

These facts point toward several conclusions about the role of robo-voting in corporate governance. First, since robo-voters are rarely pivotal in corporate elections, their overall influence on corporate governance is likely modest, which is not to say that concerns about robo-voting should be entirely dismissed. Our estimates of robo-voting are low because we do not include robo-voting by pension funds, which we suspect is substantial. Our evidence also understates the prevalence of automatic voting because some funds may adopt a partial robo-voting strategy in which they monitor a small number of select issues and then fully delegate their voting decisions on other issues. Also, although robo-voters are rarely pivotal, they are more likely to matter in close elections (by definition), and those elections may have the biggest impact on corporate governance. We might expect partial robo-voting to grow as automation becomes easier.

ENDNOTE:

[1] The SEC’s 2019 preliminary report Amendments to Exemptions from the Proxy Rules for Proxy Voting Advice (Release No. 34-87457) considered and ultimately dismissed the idea of rule to counteract robo-voting by requiring that pre-populated and automatic voting mechanisms be disabled (Section III.E.5).

[2] Gallagher, Daniel, Remarks at Society of Corporate Secretaries and Governance Professionals, July 11, 2013, available at: https://www.sec.gov/news/speech/spch071113dmghtm.

[3] Doyle, Timothy M., The Realities of Robo-Voting, American Council of Capital Formation, November 2018, available at: https://accf.org/2018/11/09/the-realities-of-robo-voting/.

[4] Bolton, Patrick, Tao Li, Enrichetta Ravina, and Howard Rosenthal, “Investor Ideology,” Journal of Financial Economics, 2020, Vol. 137, 320-352. Matsusaka, John G. and Chong Shu, “Does Proxy Advice Allow Funds to Cast Informed Votes?,” working paper, University of Southern California and University of Utah, 2022, available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3866041.

[5] Sharfman reports the number of items voted by Vanguard. See, Sharfman, Bernard S., “The Risks and Rewards of Shareholder Voting,” SMU Law Review, 2020, Vol. 73(4), 849-889.

[6] U. S. Securities Exchange Commission (2018): Gary Retelny, CEO of ISS, “[t]he majority of ISS’s institutional shareholders – actually 87 percent of the shares that we execute votes for – vote as per their own custom policies” (p. 192); Katherine Rabin, CEO of Glass Lewis: “[a]t least 80 percent of the voting that’s getting done is getting done in some customized way that isn’t actually similar to ours” (p. 193). Quote on robo-voting not existing from Scott Draeger, Vice President and General Counsel at R. M. Davis Inc. (p. 195).

[7] Shu, Chong, “The Proxy Advisory Industry: Influencing and Being Influenced,” working paper, University of Utah, 2022, available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3614314.

This post comes to us from professors John G. Matsusaka at the University of Southern California and Chong Shu at the University of Utah. It is based on their new paper, “Robo-Voting: Does Delegated Proxy Voting Pose a Challenge for Shareholder Democracy?” forthcoming in the Seattle University Law Review and available here.

Sky Blog

Sky Blog