The Supreme Court is about to eviscerate the SEC’s power to efficiently pursue fraudsters.

Or so we are told.

In SEC v. Jarkesy, the Court may hold that whenever the SEC seeks to impose monetary penalties on enforcement targets for securities fraud, it must proceed in federal court and not in its own administrative forum. Many observers predict this would significantly hamper SEC enforcement.

For some, this would be a glorious restoration of fundamental individual rights and a much-needed constraint on an oppressive and unaccountable administrative state. For others, this would mark the culmination of a decades-long anti-democratic assault on government by big business to eliminate any and all economic regulation.

But Jarkesy’s effect on SEC enforcement is likely far less significant than common wisdom suggests. Indeed, SEC enforcement may well emerge virtually unscathed.

In a new paper, I identify a simple legal patch that might repair the hole Jarkesy is poised to open in SEC enforcement. The patch is based on the idea that parties who register with the SEC thereby consent to its administrative jurisdiction.

“Registration” is the licensing system for the securities industry; under the federal laws and rules that the SEC administers, it is unlawful to engage in certain lines of securities business without registering. Registrants take on a host of burdens in exchange for the license to conduct business. After Jarkesy, it may be reasonably argued that one of those burdens is exposure to SEC’s administrative jurisdiction.

Drawing on Supreme Court precedent on consent to otherwise unconstitutional adjudications – including Mallory v. Norfolk Southern Railway Co., Wellness Int’l Network, Ltd. v. Sharif, and CFTC v. Schor – I show how SEC registrants could be deemed to have consented to SEC administrative adjudication via new SEC interpretive guidance or by amending a few regulatory forms.

The Court has already held several times that parties may be coerced to give their “consent” to otherwise unconstitutional adjudications through compulsory registration regimes. SEC registration may similarly constitute effective “consent” to a type of adjudication that would have otherwise been unconstitutional. And even if the existing registration system doesn’t quite do this, the SEC could quickly adopt new interpretive guidance or amend a few registration forms to make it so.

Before 2010, Congress had never given the SEC authority to seek monetary penalties in administrative proceedings from unregistered parties. My claim is that this historical practice was not merely a matter of policy discretion but was, in effect, the legislative crystallization of a constitutional mandate.

The Court in Jarkesy is unlikely to definitively resolve the constitutional status of registration because the parties bringing the constitutional questions to the Court here were not registered. Although Jarkesy had emphatically linked his unregistered status to his Seventh Amendment claim at earlier stages of litigation, he conspicuously dropped the point in his Supreme Court filings. Thus, the question will be left open – and, in that gap, the SEC can reasonably take the position (including via guidance or amending forms) that, going forward, registered parties have consented to its jurisdiction.

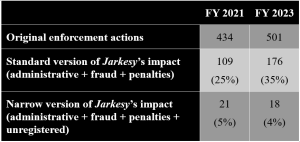

If registration does constitute consent to the SEC’s administrative jurisdiction, this would substantially insulate SEC enforcement from virtually any impact from Jarkesy. I review all original enforcement actions the SEC brought in FY 2021 and FY 2023 to determine how broadly the Jarkesy Seventh Amendment holding would sweep – both under the standard reading and under my narrowed one. The results are presented in the table below:

On the standard reading, Jarkesy strips the SEC of the ability to pursue administrative enforcement actions for fraud-related misconduct seeking monetary penalties against all parties – registered or unregistered. Under that reading, Jarkesy would indeed have a very significant impact on SEC enforcement – affecting about a quarter to a third of the agency’s enforcement docket.

But once my proposed legal patch is applied, the effects of Jarkesy all but disappear. If the SEC loses the ability to pursue administrative enforcement actions for fraud-related misconduct seeking monetary penalties only against unregistered parties, the impact of the decision shrinks to just 4-5 percent of the SEC’s enforcement docket.

The bottom line: Jarkesy’s impact on SEC enforcement may be substantially reduced if registration constitutes consent. Limiting Jarkesy to unregistered persons (like Jarkesy himself) would allow SEC enforcement to proceed virtually unchanged.

This post comes to us from Alexander I. Platt, an associate professor at the University of Kansas School of Law. It is based on his recent article, “Registration as Consent: Patching Jarkesy’s Hole in SEC Enforcement,” available here.

Sky Blog

Sky Blog