All eyes are on Delaware, where soon the Delaware Bar Association will recommend to the state legislature whether or not to curb the Delaware Supreme Court’s decision last year to uphold the facial validity of a board-approved bylaw that shifted …

About two months ago, this columnist was asked to prepare a short report to the SEC’s Investor Advisory Committee on the then still largely unnoticed trend toward bylaw and charter provisions that imposed some form of a “loser pays” rule …

Corporate law normally moves at a glacial pace, but sometimes there are periods of rapid change, much of it invisible to the ordinary observer. 2014 may be witnessing such a period of rapid, low-visibility change. Between May 29 and September …

Hedge fund activism has increased almost hyperbolically. Some view this optimistically as a means for bridging the separation of ownership and control; others are more pessimistic, seeing mainly wealth transfers from bondholders or speculative expectations of a takeover as fueling …

Not since Felix and Oscar teamed up in the Odd Couple has there been a more curious collaboration.[1] Pershing Square Capital Management L.P. and Valeant Pharmaceuticals International, Inc. have entered into a short-term marriage of convenience to facilitate Valeant’s hostile …

High frequency trading has more enemies than friends, but the key question is what are the costs of reform. Attorney General Schneiderman’s pending suit against Barclays PLC for allegedly misrepresenting that its dark pool (known as “LX”) was “safe” from …

Ask any plaintiff’s lawyer about Halliburton II, and you will hear a predictable response: “Whew! We Dodged the Bullet!” But that is not entirely accurate. The bullet hit, but inflicted a non-fatal wound. Prior to Halliburton II, class …

Two recent developments have changed the playing field of corporate governance: (1) the Delaware Chancery Court’s ruling this month on the use of a two-tier poison pill in the Sotheby’s case (and Sotheby’s quick and conciliatory settlement two days later, …

In 2012, the Republicans learned an important lesson: neither the White House nor many Congressional Democrats would resist major deregulation of the federal securities laws if that deregulation was packaged as a “JOBS Act.” 2014 is also an election year, …

You can’t make this stuff up. Reality is more bizarre than fiction. Good as “House of Cards” or “Game of Thrones” are, they cannot match the Herbalife battle for the sheer confrontation of economic power, the treachery among rivals, or …

Like children on Christmas Eve, securities defense attorneys and corporate executives are waiting in hopeful anticipation for the Supreme Court’s coming decision in Halliburton Co. v. Erica P. John Fund, Inc. (“Halliburton II”), which may overrule the “fraud on the market” doctrine (“FOTM”) that was announced over a quarter century ago in Basic v. Levinson.[1] Academics are divided, with probably the majority fearing the loss of general deterrence if the securities class action is substantially undercut. Conversely, a minority (including this author) believe it is remarkable that FOTM has survived as long as it has because it is extraordinarily ill-suited to the real world of securities fraud (as hereafter explained). A third more nervous group of spectators are the managing partners of litigation-oriented law firms, who know that FOTM’s potential abolition would likely imply a steep decline in securities litigation, which is the staple of their practice. Ironically, some of the securities defense attorneys eagerly awaiting FOTM’s demise may next year be learning how to litigate patent cases. Be careful then what you wish for, as you may get it.

Almost everyone has an opinion about securities enforcement. Many are disappointed (and even angry) that “few high level executives” have been prosecuted (criminally or even civilly) in connection with the 2008 financial crisis.[1] Deep in their bunker, the SEC …

The “London Whale” is far from the financial crime of the century, but it may well be the financial blunder of the decade. Crimes and blunders are, of course, different, but the slow and inconsistent response by JPMorgan Chase & …

Is the SEC capable of blushing? Increasingly, there are occasions in which the Securities and Exchange Commission takes positions so inconsistent with the protection of investors and its own history and so deferential to the industry that one has to …

In a delightful essay, Ron Gilson and Jeff Gordon remind us that the times have changed and the Williams Act belongs in their view to the era of the Beatles. (Personally, I have trouble believing that Sgt. Pepper was really …

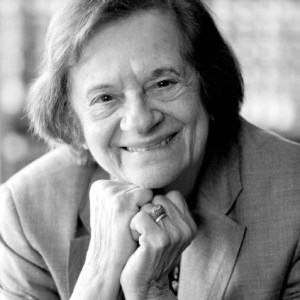

The Institute for the Fiduciary Standard, a non-profit organization dedicated to the advancement of fiduciary principles, has awarded its first ever Tamar Frankel Fiduciary Prize to Robert A.G. Monks, the corporate governance activist and scholar. The Frankel Fiduciary Prize is …

In a move that appears at once to be shrewd, savvy and largely symbolic, the SEC has modified its longstanding policy that it will not require a defendant to admit or deny liability, or facts that might establish its liability,

…

In a free-swinging and provocative attack, Brandon Gold, a graduating Harvard Law School student, argues (1) that third party bonuses, paid by hedge funds or others soliciting proxies, to their director nominees are acceptable and even desirable, and (2) that …

This is the season for report cards and grades. The securities laws are enforced by the plaintiff’s bar and the SEC. How well are they doing? What grades do they deserve?

I. Private Enforcement

In terms of private litigation, 2012 …

The Institute For The Fiduciary Standard, a non-profit organization based in Washington, D.C., has created a prize—to be known as the Tamar Frankel Fiduciary Prize—which will be awarded annually to a person who has made a “significant contribution to the …

Sky Blog

Sky Blog