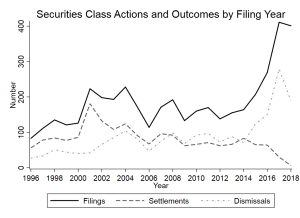

Do institutional investors have the ability to mitigate information asymmetries around complex corporate events? Securities class actions (SCA) are suitable for testing any informational advantage for institutional investors: The number of SCAs brought against U.S. firms has increased markedly in the last two decades, as has their heterogeneity. SCA filings ranged from 83 to 135 per year in the late 1990s. Of these, between 62 percent and 70 percent were settled out of court. However, by the late 2010s, the number of SCA filings increased to between 164 to 411 per year, of which 1.4 percent to 51 percent were settled. These settlements are costly when they occur, with an average payout of $47 million between 2009 and 2018, adjusted for inflation (Cornerstone Research, 2018).

There is substantial evidence that not all SCAs are filed in response to managerial malfeasance or negligence, poor corporate governance, or similar wrongdoing. The passage of the Private Securities Litigation Reform Act (PSLRA) in 1995 has curbed some abuses of the class action system such as extracting payouts from firms through unjustified merger objections and other meritless lawsuits. However, recent work by Kempf and Spalt (2019) finds evidence of continuing use of meritless SCAs to tax innovative firms, consistent with prior work highlighting the potential for abuse of SCAs by Alexander (1990) and Romano (1991). As Figure 1 shows, the lower settlement rate in recent years reflects the reduced probability of success of each SCA as a consequence of their overall increase (Chubb Limited, 2019).

This uncertainty about the outcome of SCAs, both in terms of the merits of the case and costs incurred by the target forced to settle regardless of those merits, creates significant costs to shareholders of targets. Prior work has shown that certain types of institutional owners, particularly ones that hold a narrowly selected portfolio of stocks over a long horizon, can improve the quality of information about these portfolio firms (Borochin and Yang, 2017). In a new paper, we examine whether institutional owners generally, or one of their subtypes, can mitigate the uncertainty arising out of SCA filings by helping market participants separate meritorious lawsuits from meritless ones, particularly in the case of more complex SCAs. We make three main contributions:

First, we demonstrate that machine readability of SCA filings is an informative measure about the ultimate outcome of the lawsuit: Individual machine readability scores, as well as their first principal component, are inversely related to the likelihood of settlement at the 1 percent statistical significance level. That is, more complex SCA complaints are more likely to be settled, consistent with the Kempf and Spalt (2019) argument that they can be used as a tax on firms with a high opportunity cost of time and money. More complex SCA complaints also take longer to resolve, with statistical significance at the 1 percent level, suggesting that machine readability correlates with greater real case complexity.

Second, we demonstrate that less readable SCA filings produce a more muted 10-day post-announcement price reaction than more readable filings do, consistent with less efficient incorporation of their content into prices. To verify that machine readability of SCA filings correlates with greater informativeness rather than simply with more negative market reactions, we also measure its relation to the abnormal return variance ratio as a proxy for new information being incorporated into market prices. We find that more readable (less complex) SCA filings produce significantly greater variance ratios than less readable (more complex) ones up to 100 days after the filing date, consistent with greater information content of post-announcement prices. Notably, we demonstrate that this readability factor contains information not explained by mere length, in contrast to readability analysis of financial disclosures (Loughran and McDonald, 2014).

Third, we find that post-announcement price reactions are more positive for SCA targets with above-median institutional ownership in the quarter prior to the filing. This effect is most pronounced for long-term institutional owners at all time horizons. The positive relation between post-SCA price reaction and above-median institutional ownership appears to also be driven by greater post-event price informativeness. The abnormal variance ratio is higher for all institutional ownership types at the 1 percent significance level, with the exception of the transient-owner type consistent with their information disadvantage in firm valuation (Borochin and Yang, 2017).

Importantly, we find a significant interaction between the effects of the first principal component of SCA readability scores and institutional ownership on post-announcement price reaction and price informativeness, consistent with the ability of certain institutional owner types to mitigate information asymmetries around complex SCA filings.

Our study finds both statistical and economic significance of machine readability of the content of court filings on the outcome of the cases filed. By documenting the direct relation between SCA filing complexity and the likelihood of settlement, we also add to understanding of the strategic options available to law firms drafting the filings. We thereby contribute to the recent literature on the trade-offs between the legal costs and corporate governance benefits of SCAs in the U.S. We also add to the literature on the relation between institutional ownership types and firm performance around significant events.

REFERENCES

Cornerstone Research (2018). Securities class action settlements: 2018 review and analysis. Available at http://www.cornerstone.com.

Kempf, E. and Spalt, O. G. (2019). Litigating innovation: Evidence from securities class action lawsuits. Available at SSRN 3143690.

Alexander, J. C. (1990). Do the merits matter: A study of settlements in securities class actions. Stan. L. Rev., 43:497.

Romano, R. (1991). The shareholder suit: Litigation without foundation. JL Econ. & Org.,7:55.

Chubb Limited (2019). From nuisance to menace: The rising tide of securities class action litigation. Available at www.chubb.com.

Borochin, P. and Yang, J. (2017). The effects of institutional investor objectives on firm valuation and governance. The Journal of Financial Economics, 126(1):171 – 199.

Loughran, T. and McDonald, B. (2014). Measuring readability in financial disclosures. The Journal of Finance, 69(4):1643–1671.

This post comes to us from professors Paul Borochin at the University of Miami’s Miami Herbert Business School, Xiaoqiong Wang at Indiana University Kokomo, and Siqi Wei at California State University, Northridge. It is based on their recent paper, “Can Long-Term Institutional Owners Improve Market Efficiency in Parsing Complex Legal Disputes?,” available here.

Sky Blog

Sky Blog