Our examination of the votes cast by 155 mutual funds on over 6 million corporate election items during 2004-2017 led us to a surprising conclusion: We found that Institutional Shareholder Services’ (ISS) proxy advice did not lead funds to vote as if they were informed – more often than not it pushed them in the opposite direction.

The purpose of proxy advice is to allow funds to cast their votes as if they were informed, without having to actually become informed. Given the centrality of proxy advice in today’s corporate elections, the viability of shareholder democracy hinges on the advice’s effectiveness. If it is inaccurate or unsound, as claimed by some commenters on the SEC’s 2020 proxy advice rules , for example, then corporate elections will not represent the preferences of investors, and shareholder monitoring will be ineffective. [1]

In our new paper, we estimate the extent to which proxy advice allows funds to vote as if they were informed. Previous research evaluates proxy advice based on whether it leads to value maximization. Our approach recognizes that some investors, such as socially responsible investment (SRI) funds, may have different goals than do traditional investors – and investigates whether advice allows funds to vote in alignment with their goals as they define them.

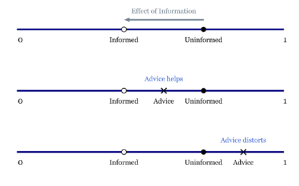

The basic idea of our study is shown in Figure 1: Effect of Information and Advice.

Suppose we can observe how funds voted if they were informed or not, and how they voted if advised. If the black circles show the percentage of uninformed funds that voted in support of a certain proposal and the open circles show the percentage of informed funds that also voted in support of that proposal, then the gap between the two circles is the effect of information (top line). In the second and third lines, the X markers are the fraction of favorable votes from funds that received proxy advice. If proxy advice replicates self-generated information, then the X marker will overlap with the open circle, and the proximity to this condition is an indicator of the quality of advice. In the middle line, proxy advice moves fund votes in the same direction as information, so advice helps. In the bottom line, proxy advice distorts the voting decision, causing funds to vote contrary to their informed preference. Our empirical strategy is to distinguish whether actual voting patterns look more like the helping or distorting cases.

The empirical challenge is actually measuring the circles and X’s – we need to know which funds were informed and which received advice. To do this we draw on two recent innovations in corporate governance research. Funds are identified as being informed if they accessed the company’s proxy statement from the SEC’s Edgar website prior to voting, which can be determined by acquiring the IP addresses of all visits to Edgar and tracing them back to funds. [2] The identity of a fund’s proxy adviser, if any, is not publicly available, but a recent paper shows it can be identified from subtle distinctions in the format of its Form N-PX filing. [3]

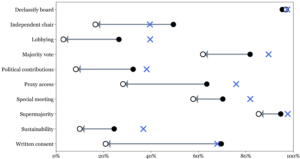

Figure 2: Votes in Favor by Informed, Uninformed, and ISS Advised, shows the findings for informed and uninformed funds, and ISS customers, on 10 prominent issues.

ISS has about 65 percent of the advice market for mutual funds. [4] Funds that acquired information (but not proxy advice) were less likely than uninformed funds to vote in favor on nine out of 10 issues. The surprising finding is that funds with ISS advice (blue X markers) shifted their votes in the opposite direction from informed funds on eight of 10 issues.

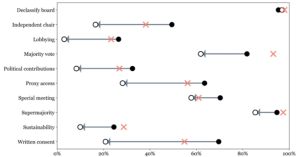

Figure 3: Votes in Favor by Informed, Uninformed and Glass Lewis Advised, shows the same information for Glass Lewis customers.

Glass Lewis has most of the 35 percent of the market that is not served by ISS. The picture is less discouraging. On six issues, Glass Lewis customers (red X markers) moved in the same direction as informed funds, and for special meetings, its customers voted almost the same as informed funds. Glass Lewis advice was associated with distorted voting on three issues.

Our findings lend support to the skepticism about proxy advice that runs through the comments of many practitioners and scholars. A question raised by our findings is why proxy advisory firms would give advice that caused funds to vote contrary to their informed preferences? We can’t pin down the explanation with complete confidence, but there are several pieces of evidence suggesting it may be a deliberate decision in response to pressure from SRI activists. SRI funds were significantly more supportive of the 10 issues than non-SRI funds were, meaning that ISS recommendations skewed voting in the direction preferred by SRI funds. We also show that a large fraction of ISS’ non-SRI customers “robo-vote,” meaning they mechanically follow ISS’ recommendations on every issue. If an activist wanted to swing a corporate election, influencing ISS’ recommendation would provide a lot of leverage.

This story, which we view as provisional, comports with elements of a model developed in another paper that we discussed in a previous post on the Blue Sky Blog. [5] Our theoretical model explains why proxy advisory firms would slant advice toward the preferences of SRI funds, even if SRI funds are a minor segment of their customers. Intuitively, catering to SRI funds in this way can be profit-maximizing for proxy advisers if (a) SRI funds care a lot about vote recommendations; and (b) non-SRI funds are less concerned about voting accurately and more concerned about acquiring the adviser’s vote-execution services and a safe harbor from SEC fiduciary regulations. The idea that activists might try to influence elections by changing proxy adviser recommendations squares with anecdotal evidence. One of the goals of an impact investing initiative co-sponsored by leading SRI funds including Calvert, Trillium, Boston Common, and Northstar is, for example, to “engage with proxy advisory firms, such as ISS and Glass Lewis, regarding upcoming shareholder resolutions in order to encourage their support.” [6]

All of this suggests that proxy advisers might be a vulnerable link in the voting chain. Because a substantial and growing number of passive funds mechanically follow the recommendations of their advisers, activists can influence corporate elections by gaining control of ISS recommendations. From a policy perspective, this calls for continued investigation of the role of passive funds in shareholder democracy, and reinforces questions about the wisdom of requiring funds to vote. [7] It also suggests that greater disclosure by proxy advisers about how they come up with their recommendations may be valuable; at present the process is completely opaque to outsiders.

ENDNOTES

[1] Securities and Exchange Commission, “Exemptions from the Proxy Rules for Proxy Voting Advice,” 17 CFR Part 240, November 2, 2020: https://www.sec.gov/rules/final/2020/34-89372.pdf.

[2] Iliev, Peter and Kalodimos, Jonathan and Lowry, Michelle B., Investors’ Attention to Corporate Governance (November 22, 2020). Review of Financial Studies, forthcoming.

[3] Shu, Chong, The Proxy Advisory Industry: Influencing and Being Influenced (March 19, 2021). USC Marshall School of Business Research Paper. https://ssrn.com/abstract=3614314. The paper was summarized in the CLS Blue Sky Blog, https://clsbluesky.law.columbia.edu/2020/06/25/the-competitive-landscape-of-the-proxy-advice-market/

[4] Id.

[5] Matsusaka, John G. and Shu, Chong, A Theory of Proxy Advice when Investors Have Social Goals (April 6, 2021). USC Marshall School of Business Research Paper. https://ssrn.com/abstract=3547880. The paper was summarized in the CLS Blue Sky Blog, https://clsbluesky.law.columbia.edu/2020/04/30/why-proxy-advice-might-be-slanted

[6] Croatan Institute, The Impact of Equity Engagement: Evaluating the Impact of Shareholder Engagement in Public Equity Investing, November 2014, available at: https://croataninstitute.org/documents/IE2_Report.pdf.

[7] Lund, Dorothy S., “The Case against Passive Shareholder Voting,” Journal of Corporation Law, 2018, Vol. 43(3), 493-536.

This post comes to us from John G. Matsusaka, a professor at the University of Southern California, and Chong Shu, an assistant professor at the University of Utah. This post is based on their new working paper, “Does Proxy Advice Allow Funds to Cast Informed Votes?” available here.

Sky Blog

Sky Blog