Insider Trading: Personal Benefit Has No Place in Misappropriation Tipping Cases

The Supreme Court’s decision last December in Salman v. United States[1] settled important issues concerning Rule 10b-5’s reach over trades based on a tip of confidential material information. One important question, however, remains unanswered: In tipping cases based on …

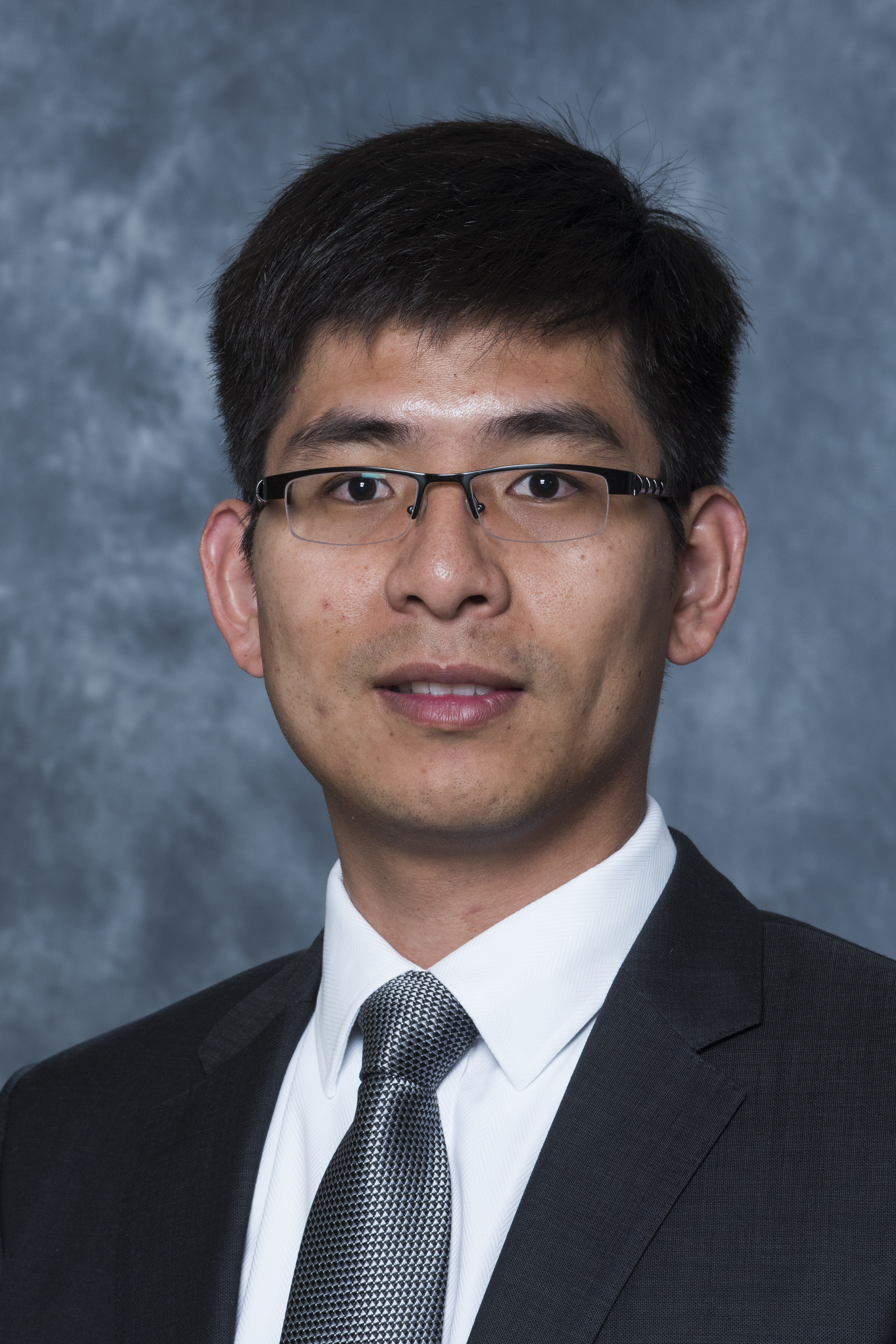

Sky Blog

Sky Blog