This Tuesday, May 21, shareholders at JP Morgan Chase & Co. (“JPMorgan”) will vote on whether the bank should separate the roles of chairman and CEO. Currently, Jamie Dimon holds both titles. The impending vote is not binding on the …

As annual meeting season approaches, so too does the first deadline for companies listed on the NASDAQ Stock Market (Nasdaq) to comply with amended compensation committee rules. Traditionally, evaluation of director independence of Nasdaq-listed companies differed for purposes of serving …

China now has the second-largest number of Fortune Global 500 companies in the world. Most of the Chinese companies on the list are state-owned enterprises (sometimes called “SOEs”) organized into massive corporate groups with a central government agency as their …

This year, the practice of activist hedge funds engaged in proxy contests offering special compensation schemes to their dissident director nominees has increased and become even more egregious. While the terms of these schemes vary, the general thrust is that, …

The following post comes to us from Professor Mariana Pargendler of the Fundação Getulio Vargas School of Law at São Paulo, Brazil.

Despite prior waves of privatization, state-owned enterprises (SOEs) remain a fixture of the variety of capitalism embraced by …

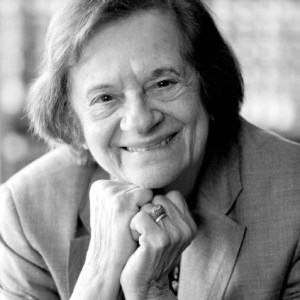

The Institute For The Fiduciary Standard, a non-profit organization based in Washington, D.C., has created a prize—to be known as the Tamar Frankel Fiduciary Prize—which will be awarded annually to a person who has made a “significant contribution to the …

Equity ownership in the United States no longer reflects the dispersed share ownership of the canonical Berle-Means firm. Instead, in our new working paper, The Agency Costs of Agency Capital: Activist Investors and the Revaluation of Governance Rights, Ron …

In recent years, the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) have aggressively investigated and enforced both the anti-bribery and accounting provisions of the Foreign Corrupt Practices Act (FCPA). Many of these matters have been the …

This is the heyday of institutional investor activism in proxy contests. Insurgents are running more slates and targeting larger companies. They are also enjoying a higher rate of success: 66% of proxy contexts this year have been at least partially …

Earlier this week, the SEC announced that it had entered into a non-prosecution agreement (NPA) with Ralph Lauren Corporation to resolve an investigation under the Foreign Corrupt Practices Act (FCPA). While the Department of Justice also announced that it had …

The partitioning of businesses into separate legal entities has been the focus of financial and legal study for decades. This literature has looked at the implications of legal separations across various dimensions such as corporate governance, limited liability, tax, and …

Securities analysts play a key role in securities markets, and publicly held companies as a matter of market practice regularly brief them to help them understand company results and business trends. There have been some unfortunate instances, however, in which …

Venture capitalists (VCs) play a significant role in the financing of high-risk, technology-based business ventures. VC exits usually take one of three forms: an initial public offering (IPO) of a portfolio company’s shares, followed by the sale of the VC’s …

In its widely followed Allergan decision, the Delaware Court of Chancery declined to apply collateral estoppel to dismiss a Delaware derivative complaint even though a California federal court dismissed (with prejudice) essentially the same complaint brought by different stockholders. The …

The imbalance in the supply and demand of venture capital of the past few years has led parties to look for new escape routes from the industry. There is the ‘survival of the fittest’ evidence that the number of active …

Yesterday, the Securities and Exchange Commission (SEC) directly addressed the application of Regulation Fair Disclosure (Regulation FD) to corporate use of social media outlets such as Facebook and Twitter. In a Report of Investigation—a format used by the SEC to …

The Dodd-Frank Act gave the SEC the authority to adopt, but did not require it to adopt, a uniform fiduciary standard of conduct for both broker-dealers and investment advisers when providing personalized investment advice about securities to retail customers. On …

Something new and significant is taking shape. For a variety of reasons—the impact of the JOBS Act, the growing popularity of equity private placements, the appearance of new trading markets for venture capital and other non-reporting companies—a new tier of companies is growing rapidly that is composed of issuers that are not "reporting" companies, but that do have a significant number of shareholders. In terms of the size of their shareholder class, these companies overlap with public companies, but they trade in the dark—and actively. More importantly, as their number grows, it is predictable that existing and new trading venues will begin to compete to attract and capture the trading interest in these stocks. This column will call these firms "semi-public companies" to reflect their intermediate status, midway between truly private firms (such as early stage venture capital startups and family-held firms) and public companies.

In the paper, “Management Influence on Investors: Evidence from Shareholder Votes on the Frequency of Say on Pay”, which was recently made publicly available on SSRN, my co-author (David Oesch of the University of St. Gallen) and I …

Sky Blog

Sky Blog