In August 2017, shortly after my arrival at the Commission, I was informed that an intrusion into the SEC’s Electronic Data Gathering, Analysis, and Retrieval (“EDGAR”) system took place in 2016. We immediately initiated a series of review and response

White Collar Crime

SEC Chair Discusses EDGAR-Hacking Enforcement Action

Toward More Efficient Corporate Knowledge

In a recent paper,[1] I argue that the criminal law needs what I call a functional approach to corporate knowledge. When the law treats corporations as though they know things, it affects how they manage information. Knowledge, in one …

Skadden Discusses How Companies Can Prepare for U.S. House Investigations

For the past several years, Republican majorities in the House of Representatives and Senate have dictated the agenda of Congress. But Democrats will take control of the House in January 2019, thereby regaining the ability to control committee and subcommittee …

Blue Sky Banter Podcast: John Coffee on the State of Insider Trading Law

Professor John C. Coffee, Jr. of Columbia Law School speaks with John Metaxas (Columbia Law ’84) about insider trading law and his role on a new task force created to develop proposals for reform in this area. The task force …

Financial Misconduct and Strategic Corporate Disclosures

Financial misconduct can lead to significant financial and reputational penalties for a firm and its managers, including hefty fines from regulators and steep drops in stock price. In fact, recent research finds that firms accused of fraud lose an average …

The Local Spillover Effect of Corporate Accounting Cases

The consequences for companies and individuals directly involved in corporate accounting misconduct are severe. Research has documented that after such misconduct is revealed, the market value of corporations declines, executives are terminated, and auditors are often dismissed. While the implications …

The Market for Lead Plaintiffs

A drama is playing out in Boston federal court before a respected judge that could prove to be a legal “Watergate,” one that could reshape class action practice.[1] Combining elements that are both sordid and comic, this litigation has …

Latham & Watkins on Second Circuit Decision Reinforcing FCPA’s Jurisdictional Limits

On August 24, 2018, the United States Court of Appeals for the Second Circuit issued its long-awaited decision in United States v. Hoskins, rebuffing an attempt by the US Department of Justice (the Department, or DOJ) to expand the …

What Happened to “Meaningfully Close Personal Relationship” in Insider Trading?

Did insider trading law almost devolve into an effort to define what kind of relationship a tipper and tippee must have for a defendant to be liable? And was any federal judge or jury qualified to say? Since the Second …

Regulation by Prosecutor

There is a quaint perspective from which the prosecutor’s role is limited to investigating crime and advocating for punishment. Of course, prosecutors serve both these functions, but the description is far too narrow to capture the work of the modern …

Sullivan & Cromwell Discusses How FCPA Enforcement Will Affect M&A

During a speech delivered on July 25, 2018 at the American Conference Institute 9th Global Forum on Anti-Corruption Compliance in High Risk Markets, Deputy Assistant Attorney General Matthew Miner, who oversees the U.S. Department of Justice’s (“DOJ”) Fraud Section …

Cleary Gottlieb Discusses Ruling that FIRREA Statute of Limitations Covers Offenses by Banks

A federal district court in California has become the latest court to hold that the 10-year statute of limitations under the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (“FIRREA”) for offenses “affecting a financial institution” extends to offenses …

Gibson Dunn Offers Update on Corporate Non-Prosecution and Deferred Prosecution Agreements

This publication marks our tenth year tracking corporate non-prosecution agreements (“NPAs”) and deferred prosecution agreements (“DPAs”).[1] What a decade it has been. In our time analyzing and reporting on these resolutions, we have seen the pendulum swing from 22 …

Davis Polk Discusses Ruling on Statute of Limitations for N.Y.’s Martin Act

On June 12, 2018, the New York Court of Appeals overruled longstanding Appellate Division precedent and held that fraud claims brought by the New York Attorney General (“NYAG”) under the Martin Act (General Business Law article 23-A, § 352…

Financial Misreporting: Hiding in the Shadows or in Plain Sight?

It’s widely assumed that executives are less likely to inflate earnings at high profile companies under a good deal of regulatory oversight. And yet it’s also widely known that managers in high profile companies have an incentive to overstate their …

Financial Enforcement Actions and the Role of Whistleblowers

In our recent paper, we investigate the association between employee whistleblowers and outcomes of financial misrepresentation enforcement actions by the Securities and Exchange Commission (SEC) and Department of Justice (DOJ). We examine SEC and DOJ enforcement actions for financial misrepresentation …

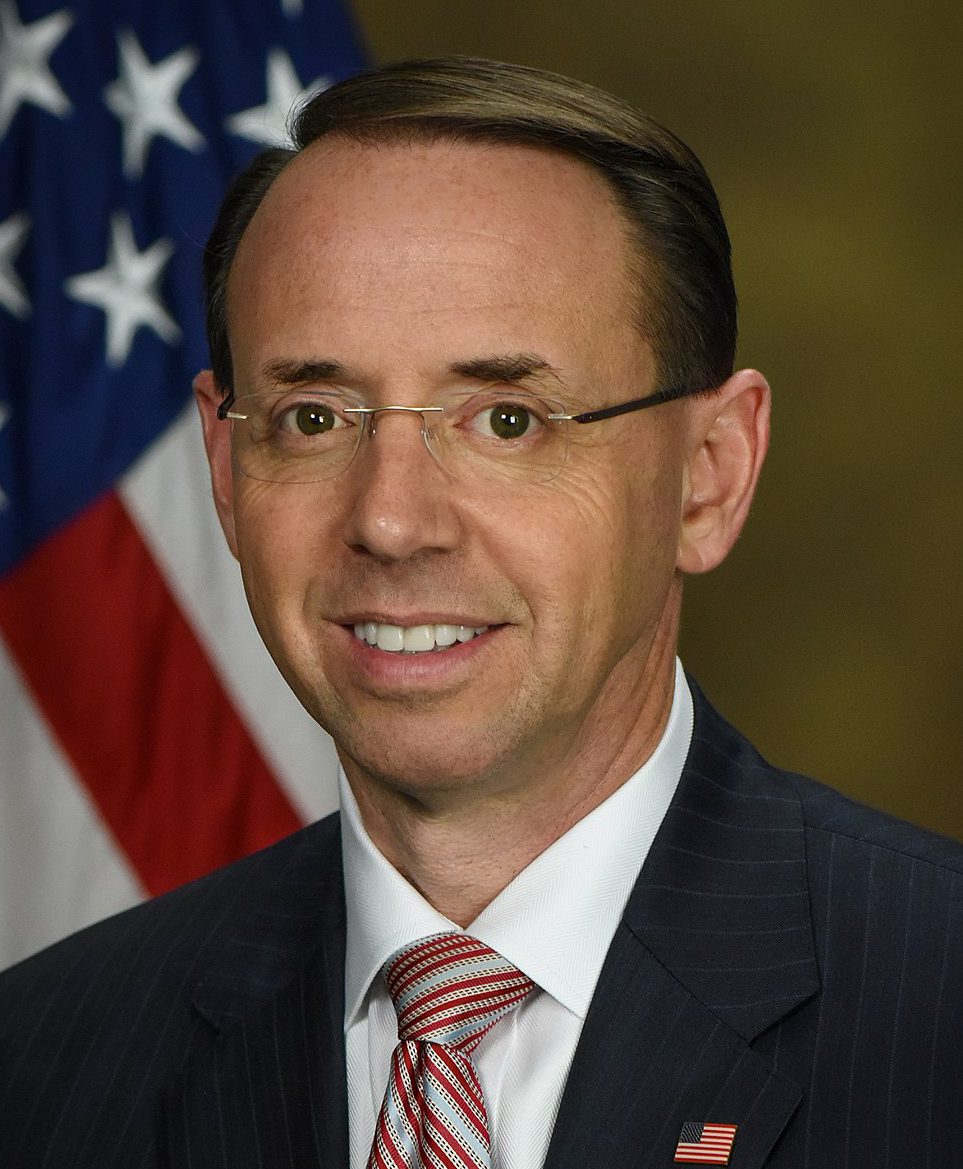

Deputy AG Rod Rosenstein Rejects “Piling On” Companies in Enforcement Actions

I am very happy to be with you in Manhattan. You may have heard that I have been kind of busy in Washington.

After I speak with you this morning, I need to head across Times Square to participate in …

Cleary Gottlieb Discusses Second Circuit’s Reversals of RMBS Trader’s Fraud Conviction

On May 3, the Second Circuit vacated on evidentiary grounds Jesse Litvak’s conviction – after a second trial – on a single count of securities fraud related to trades of residential mortgage backed securities (“RMBS”) and remanded the case to …

Detection of Insider Abuse and Fraud Among U.S. Failed Banks

The U.S. banking industry has exhibited increasing vulnerability to economic cycles since the easing of post-depression era measures designed to insulate banking from economic instability. Between 1934 and 2017 there were 2,758 commercial and savings bank failures.[1] Nearly 80 …

Sky Blog

Sky Blog